Condo Insurance in and around Hudson

Condo unitowners of Hudson, State Farm has you covered.

State Farm can help you with condo insurance

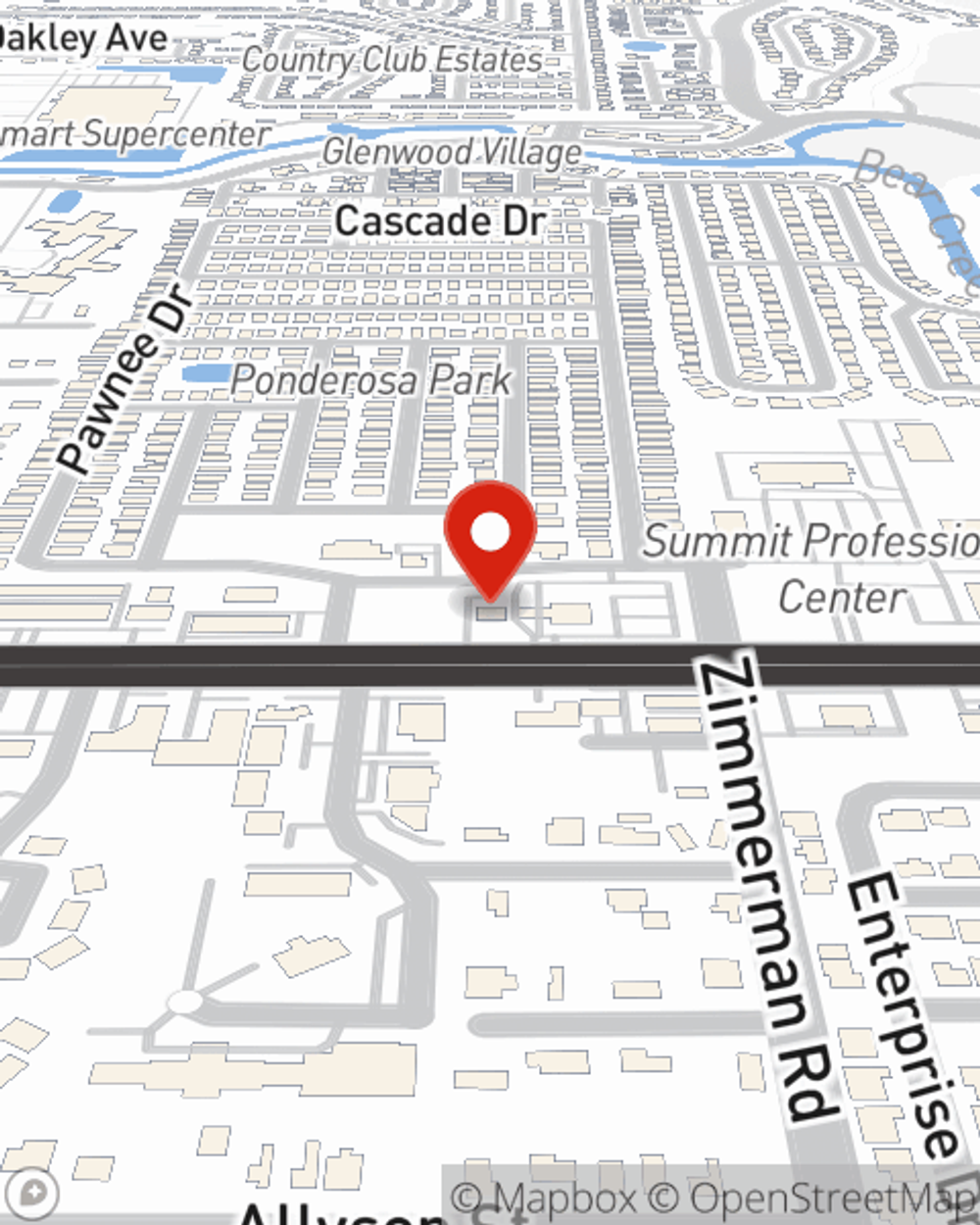

- Hudson, Florida

- Port Richey, Florida

- New Port Richey, Fl

- Spring Hill, FL

- Holiday, FL

- Tarpon Springs, FL

Calling All Condo Unitowners!

As with anything in life, it is a good idea to expect the unexpected and attempt to prepare accordingly. When owning a condo, the unexpected could look like damage to your largest asset from theft fire, weight of ice, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Condo unitowners of Hudson, State Farm has you covered.

State Farm can help you with condo insurance

Protect Your Condo With Insurance From State Farm

Despite the possibility of the unexpected, the future looks bright when you have the terrific coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your unit and personal property inside, you'll also want to check out bundling options for replacement costs, and more! Agent Kim Brust can help you generate a plan based on your needs.

If you want to find out more information, State Farm agent Kim Brust is ready to help! Simply contact Kim Brust today and say you are interested in this fantastic coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Kim at (727) 862-7399 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.